Any changes mentioned and reported in Form 1040-X - since this form purports to amend any lost credits or adjust taxes - will be added and included to your original return. It should also be noted that, when you submit Form 1040-X to the IRS for a tax year, it will become your new tax return for that year.

How do I fill out Form 1040-X?įirst and foremost, you will need the following documents and information when filling out Form 1040-X. It should also be noted that the deadline of submitting Form 1040-X can be suspended for individuals who are incapable, physically or mentally, of handling their finances. If you are filing for Form 1040-X to get a refund on your credit, it is instructed by the IRS that you file for the document within three (3 years) following the date of your original return or within two (2) years following the date you paid the tax. It should be noted that you should file and submit Form 1040-X only if and after you have filed your original return.

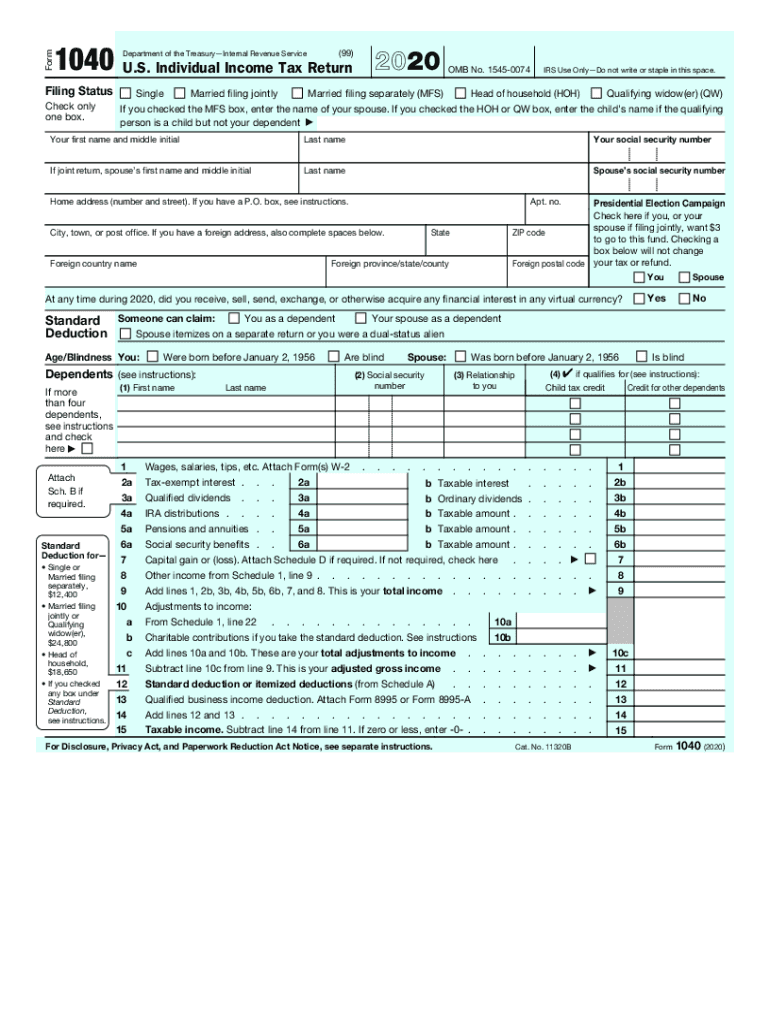

When should you file and submit Form 1040-X? You may download a copy of Form 1040-X above or fill it out electronically using our PDF Editing Software. You may now fill out and file Form 1040-X electronically. Where should you file and submit Form 1040-X? People whose tax amounts were adjusted by the IRS that are due for payment but need to be revised should also file for Form 1040-X. People who have accomplished and submitted forms 1040, 1040-SR, 1040A, 1040EZ, 1040-NR, or 1040-NR-EZ that need to have the tax amount stated on the documents corrected should file for Form 1040-X. Have your unused or lost credit refunded.Adjust/revise the tax amounts initially made by the IRS.Gives you the opportunity to make elections.Purpose of Form 1040-X?Īside from acting as your formal document for refund, filing for Form 1040-X also enables you to do the following: Form 1040-X is used for when additional deductions or credits are needed on the amount of tax you are supposed to be paying for the year or when there has been a mistake that reduces that tax amount you are due to pay that needs to be corrected. Individual Income Tax Return, or Form 1040-X, is a legal document that you need to fill out in order for it to act as your valid claim for a refund.

0 kommentar(er)

0 kommentar(er)